What lies ahead: major cross-currents

To know and understand what’s going on is basic to our development as individuals in an ever faster paced changing world.

We must be able to see our opportunities.

Let’s take a close look at the major cross-currents of our current situation.

- Technology brings us closer to god.

- Labor in China is cheap.

- Helicopter Ben has the dollar spout wide open.

- Oil is scarce.

Heidegger made this bold statement alluding to the fact that technology brings us forth by increasing our knowledge of doing. So much so, that some day we may well approach the idealized virtues of a Greek god: know it all, omnipresent, omnipotent…

Haven’t we made huge advances on the first two with the Internet already?

Technology has allowed us to grow at an accelerated pace: almost doubling the efficiency of computer chips every year, according to Moore’s law.

Raymond Kurzweil, Courtesy Wikipedia

If we agree with Ray Kurzweil, and technology continues to grow as predicted by Moore’s law, then all known problems will be solved within 20 years and the universe will be intelligent in 300 years.

Let’s stop for a moment to absorb Kurzweil’s implications: among other things, within 20 years we will probably have a chance of living an eternity… Wow!

To understand technology, we must realize that it’s really about having machines do the work, or automating, or eliminating the labor involved.

Take Facebook, once it’s coded, the machine takes over, and the users provide the content. Facebook is what? five years old and it’s valued in the hundreds of billions… the rewards are enormous for the developers and investors.

So, there’s one hell of an opportunity right there: coding is automating, which is highly rewarding. Don’t like coding, wait for the Facebook IPO, or it’s cousins.

During the last 30 years, the labor arbitrage between the Chinese and western labor wages has made investors stampede their manufacturing into China, to take advantage of the inexpensive and bountiful Chinese labor.

Investors had no alternatives, either they moved their operations to China, or their competitors would…

China became an investment bottleneck, generating a liquidity glut in the world, because it made no sense to invest elsewhere, and China did not have the capacity to absorb it all.

There was so much liquidity in the world, that some gals got too creative, and some bankers too careless. The liquidity dried up with the 2008 financial meltdown.

For years the Chinese have been lending back their profits to western buyers, —buying mostly US Treasury securities—, which substantially undervalued the yuan and allowed western consumers easy access to credit, so they could continue purchasing low priced exports from China.

But a couple of years ago, the People’s Bank of China began to diversify its investments into commodities, oil wells and mines, compelling Ben Bernanke to step in to buy US government debt, to maintain the low interest rate stimulus.

It’s also becoming clear that the PBOC is beginning to lose ground in its battle against inflation, due to the rising costs of commodities and labor.

The sustained high growth of the Chinese economy is generating pockets of labor shortage —employers have raised salaries as much as 30% to keep workers with skills in high demand.

Although there’s still a long ways to go, the moves in opposite directions to an equilibrium of the labor costs —rising in China, and deteriorating salaries in the west— is rapidly closing the wage gap between East and West.

In other words, China may still be very attractive for its large consumer market potential, but it is rapidly losing its cheap labor appeal to investors.

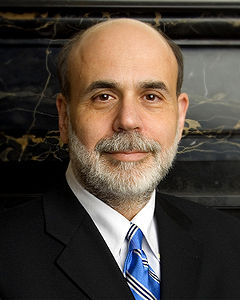

Ben Bernanke, Federal Reserve Chairman, Courtesy of Wikipedia

Ben Bernanke, the Fed Chairman, has repeatedly demonstrated his willingness to quantitatively ease the economy out of the recession.

Nothing wrong with that, as a matter of fact, I get the feeling that a lot of people never realized the trouble they’d be in if he hadn’t eased, and continue to ease, the liquidity of the economy.

But the public’s sentiment has changed. The Republicans are vehemently opposing any increase in deficit spending, and I think they have the public’s good ear.

Trouble is, the US consumer is not yet out of the rut.

Have you asked yourself why we’re getting our oil from Nigeria, Venezuela, Iraq, Iran, Libya..? Should I continue? If we’re getting our oil from all these distant or unfriendly places, it’s obvious that oil must be scarce.

In normal conditions, when the price of oil is too high, the economy slows down bringing down the price of oil with it, because of the drop in the oil demand.

But with the turmoil in the Arab world, the supply of oil could very well fall further than its demand. In this situation, you might see oil prices taking off non affected by a tanking economy. Not a pretty sight.

You have to recognize that the immediate future looks bleak.

Even if the Chinese inflation discourages investments in China back to the west, it’s tails you lose, heads you lose.

Defusing the Chinese inflation will slow its economy, dragging the rest of the world economies with it. China will also export its inflation to the west through its products’ prices.

To make matters worse, expected cutbacks in US government spending and probable oil shocks would add insult to injury.

Technology anyone?

Related articles

- The China Effect (time.com)

- Number of the Week: The ‘China Price’ Also Rises (blogs.wsj.com)

- “Zhou Pledges More Tightening; Moody’s downgrades China Property; Clouds Over Global Economy; Yuan Reserve Currency Hype” and related posts (globaleconomicanalysis.blogspot.com)

- China’s economy slows slightly, inflation hits 32-month high (latimesblogs.latimes.com)